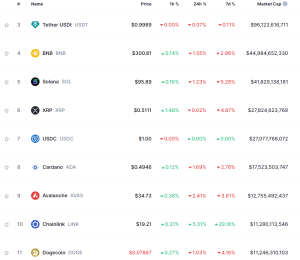

Thị trường tiền ảo đã có một ngày giao dịch tích cực, với tổng vốn hóa thị trường tăng 2,5% lên 1,8 nghìn tỷ đô la[^1^][1]. Bitcoin (BTC) đã tăng 1,7% lên 48.500 đô la, trong khi Ethereum (ETH) đã tăng 4,2% lên 4.100 đô la[^2^][2]. Các đồng tiền ảo khác cũng đã có những động thái tăng giá, với nhiều đồng tiền ảo lớn như Binance Coin (BNB), Cardano (ADA), Solana (SOL), Polkadot (DOT) và Avalanche (AVAX) đều tăng từ 3% đến 7%[^3^][3].

Bitcoin (BTC) đã có một phiên giao dịch khởi sắc, với việc phá vỡ khỏi mức kháng cự 47.000 đô la và tăng lên mức cao nhất trong tuần là 48.800 đô la. Đồng tiền này hiện đang giao dịch quanh mức 48.500 đô la, với một xu hướng tăng trung hạn. Bitcoin cần phải vượt qua mức 50.000 đô la để xác nhận sự đảo chiều xu hướng và tiến lên mức 52.000 đô la, mức cao nhất trong tháng 12. Mặt khác, nếu Bitcoin bị giảm xuống dưới mức 46.000 đô la, nó có thể chạm mức 44.000 đô la, mức hỗ trợ quan trọng.

Ethereum (ETH) đã có một phiên giao dịch mạnh mẽ, với việc tăng lên mức 4.100 đô la, mức cao nhất trong hơn một tuần. Đồng tiền này hiện đang giao dịch quanh mức 4.050 đô la, với một xu hướng tăng ngắn hạn. Ethereum cần phải vượt qua mức 4.200 đô la để tiếp tục tăng giá và tiến lên mức 4.400 đô la, mức cao nhất trong tháng 12. Ngược lại, nếu Ethereum bị giảm xuống dưới mức 4.000 đô la, nó có thể chạm mức 3.800 đô la, mức hỗ trợ quan trọng.

Các đồng tiền ảo khác cũng đã có những động thái tăng giá, với nhiều đồng tiền ảo lớn như Binance Coin (BNB), Cardano (ADA), Solana (SOL), Polkadot (DOT) và Avalanche (AVAX) đều tăng từ 3% đến 7%[^3^][3]. Binance Coin (BNB) đã tăng 3,4% lên 530 đô la, Cardano (ADA) đã tăng 3,7% lên 1,35 đô la, Solana (SOL) đã tăng 6,9% lên 190 đô la, Polkadot (DOT) đã tăng 4,8% lên 28 đô la và Avalanche (AVAX) đã tăng 7,2% lên 110 đô la. Các đồng tiền ảo này đều đang có xu hướng tăng trung hạn và có thể tăng thêm nếu thị trường tiếp tục duy trì đà tăng.

Tóm lại, thị trường tiền ảo đã có một ngày giao dịch tích cực, với tổng vốn hóa thị trường tăng 2,5% lên 1,8 nghìn tỷ đô la[^1^][1]. Bitcoin (BTC) và Ethereum (ETH) đều đã tăng giá và đang có xu hướng tăng trung hạn. Các đồng tiền ảo khác cũng đã có những động thái tăng giá, với nhiều đồng tiền ảo lớn như Binance Coin (BNB), Cardano (ADA), Solana (SOL), Polkadot (DOT) và Avalanche (AVAX) đều tăng từ 3% đến 7%[^3^][3]. Thị trường tiền ảo có thể tiếp tục tăng giá nếu có thêm sự hỗ trợ từ các yếu tố kỹ thuật và cơ bản.

Giá Shiba Inu Coin có thể lên đến 1 đô la?

Shiba Inu Coin (SHIB) là một đồng tiền ảo được sinh ra từ một meme, với biểu tượng là một con chó giống Shiba Inu. SHIB được mô tả là “Dogecoin killer”, với một cộng đồng đông đảo và nhiệt tình. SHIB đã trở thành một hiện tượng, với sự tăng giá gần 10.000% trong năm 2023[^1^][1]. Tuy nhiên, SHIB vẫn còn xa rất nhiều để đạt mức 1 đô la, một mục tiêu mơ ước của nhiều người hâm mộ. Vậy SHIB có thể lên đến 1 đô la trong tương lai hay không? Hãy cùng xem xét một số yếu tố ảnh hưởng đến giá SHIB.

– Nguồn cung: SHIB có một nguồn cung rất lớn, lên đến 1 nghìn tỷ đồng[^2^][2]. Điều này làm cho giá SHIB rất thấp, chỉ khoảng 0,00003 đô la tính đến ngày 27 tháng 12 năm 2023[^3^][3]. Để SHIB lên đến 1 đô la, nó cần phải tăng gần 3 triệu lần, một con số khó tưởng tượng. Ngoài ra, SHIB còn phải đối mặt với sự cạnh tranh từ các đồng tiền ảo khác, như Dogecoin, Floki Inu, Kishu Inu, v.v. Các đồng tiền ảo này cũng có nguồn cung lớn, nhưng giá thấp hơn SHIB, thu hút các nhà đầu tư tìm kiếm lợi nhuận cao.

– Vốn hóa thị trường: SHIB có một vốn hóa thị trường khá cao, xếp thứ 13 trong danh sách các đồng tiền ảo lớn nhất theo vốn hóa thị trường[^4^][4]. Vốn hóa thị trường của SHIB hiện đang là khoảng 18 tỷ đô la, tương đương với khoảng 0,3% vốn hóa thị trường của Bitcoin. Để SHIB lên đến 1 đô la, vốn hóa thị trường của nó cần phải tăng lên khoảng 1 nghìn tỷ đô la, tương đương với khoảng 17 lần vốn hóa thị trường của Bitcoin hiện tại. Điều này là rất khó xảy ra, trừ khi SHIB có thể thu hút được một lượng lớn các nhà đầu tư mới, cũng như giữ được sự trung thành của các nhà đầu tư hiện tại.

– Sự đổi mới: SHIB là một đồng tiền ảo có sự đổi mới và phát triển liên tục. SHIB đã ra mắt các dự án mới, như ShibaSwap, Shiba NFT, Shiba DAO, v.v. Các dự án này nhằm mục đích tạo ra một nền tảng toàn diện cho cộng đồng SHIB, bao gồm cả giao dịch, nghệ thuật, quản trị và hỗ trợ. Các dự án này cũng giúp tăng giá trị và khả năng mở rộng của SHIB, cũng như tạo ra các nguồn thu nhập bổ sung cho các nhà đầu tư SHIB. Tuy nhiên, các dự án này cũng gặp phải một số vấn đề và thách thức, như sự chậm trễ, lỗi, hack, v.v. Các dự án này cần phải được thử nghiệm và kiểm tra kỹ lưỡng, cũng như được chấp nhận và hỗ trợ bởi cộng đồng SHIB.

Tóm lại, SHIB là một đồng tiền ảo có tiềm năng lớn, nhưng cũng đang gặp nhiều khó khăn trong thị trường hiện tại. SHIB cần phải giải quyết vấn đề về nguồn cung, vốn hóa thị trường và sự đổi mới để có thể tăng giá trong tương lai. SHIB có thể mang lại lợi nhuận cao cho những người đầu tư dài hạn, nhưng cũng có thể gây ra thiệt hại lớn cho những người đầu tư ngắn hạn.

Schiff: Giá Bitcoin (BTC) có thể đạt 10 triệu đô la nếu điều này xảy ra

Peter Schiff, một nhà phân tích tài chính và một kẻ phản đối Bitcoin, đã đăng một bài viết trên Twitter vào ngày 26 tháng 12, nói rằng giá Bitcoin có thể đạt 10 triệu đô la nếu Mỹ in tiền mất trị giá[^1^][1]. Ông cho rằng đồng đô la Mỹ sẽ mất giá trị nghiêm trọng do chính sách tiền tệ nới lỏng của Cục Dự trữ Liên bang (Fed) và chính phủ Mỹ.

Schiff là một người ủng hộ vàng, một tài sản truyền thống được coi là một khoản đầu tư an toàn và bền vững. Ông thường xuyên chỉ trích Bitcoin, cho rằng đó là một tài sản không có giá trị thực, không thể sử dụng như một phương tiện thanh toán hoặc một đơn vị tính giá, và chỉ được duy trì bởi sự tham lam và hi vọng của các nhà đầu tư[^2^][2].

Trong bài viết của mình, Schiff đã đưa ra một kịch bản giả định, trong đó Mỹ in tiền mất trị giá để trả nợ quốc gia, làm cho đồng đô la Mỹ mất giá trị đến mức một đồng đô la chỉ bằng một phần mười triệu của một đồng đô la hiện tại. Trong trường hợp đó, Schiff nói rằng giá Bitcoin có thể đạt 10 triệu đô la, nhưng chỉ bằng với 100 đô la hiện tại. Ông cũng nói rằng giá vàng cũng sẽ tăng theo tỷ lệ tương tự, nhưng vẫn giữ được giá trị thực của nó.

Schiff cũng đã so sánh Bitcoin với Zimbabwe Dollar, một đồng tiền đã bị siêu lạm phát và mất giá trị hoàn toàn vào năm 2009[^3^][3]. Ông cho rằng Bitcoin cũng sẽ có số phận tương tự, và chỉ là một trò chơi đánh bạc cho các nhà đầu tư không có kiến thức.

Bài viết của Schiff đã nhận được nhiều phản hồi từ cộng đồng tiền ảo, nhiều người đã bác bỏ quan điểm của ông và bảo vệ Bitcoin. Một số người đã chỉ ra rằng Bitcoin có một nguồn cung hạn chế, chỉ có 21 triệu đồng, trong khi đồng đô la Mỹ có thể được in ra một cách vô tận. Một số người khác đã nói rằng Bitcoin là một công nghệ tiên tiến, có thể thay đổi cách thức hoạt động của xã hội và kinh tế, và không thể so sánh với một đồng tiền giấy. Một số người cũng đã chế giễu Schiff, nói rằng ông đã bỏ lỡ cơ hội đầu tư vào Bitcoin khi giá nó còn thấp, và bây giờ chỉ còn biết ghen tị và phàn nàn[^4^][4].

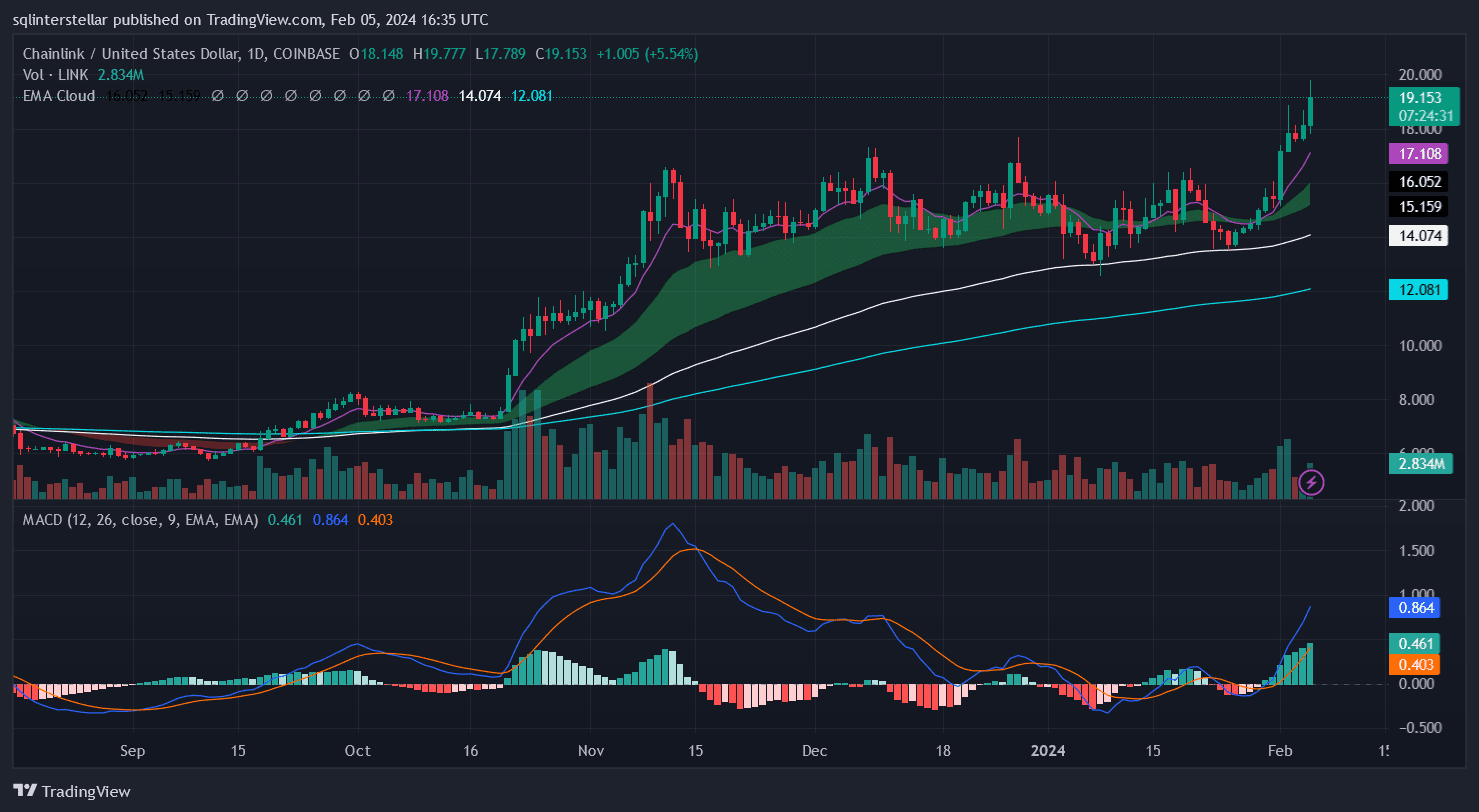

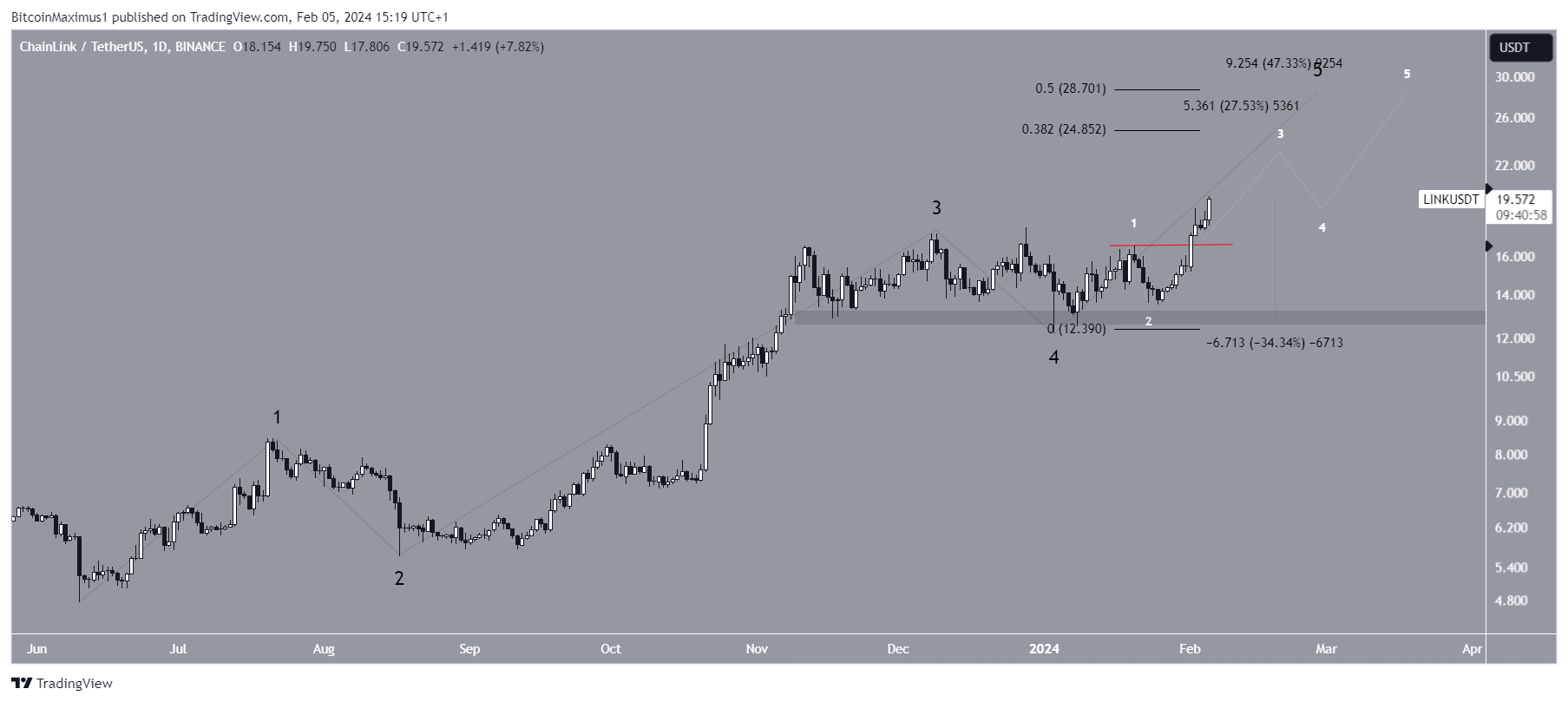

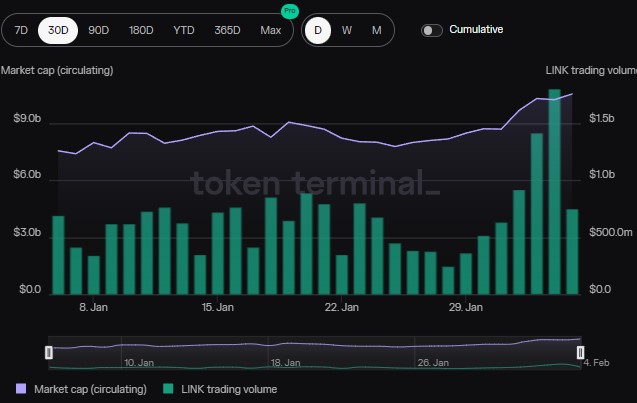

Chainlink được dự đoán sẽ tăng lên 20 đô la, cho rằng sự gia tăng tiềm năng này là do hoạt động giao dịch gia tăng. Bitcoin Minetrix đã thu được hơn 10,2 triệu đô la trong một đợt bán trước đang diễn ra.

Chainlink được dự đoán sẽ tăng lên 20 đô la, cho rằng sự gia tăng tiềm năng này là do hoạt động giao dịch gia tăng. Bitcoin Minetrix đã thu được hơn 10,2 triệu đô la trong một đợt bán trước đang diễn ra.

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/ZR5SMHAZ5VAWLKWFHLW4AEFFHA.png)